Older Americans in every part of the country depend on Social Security benefits to help make ends meet. But just how far do those payments go toward covering the basic cost of living?

Older Americans in every part of the country depend on Social Security benefits to help make ends meet. But just how far do those payments go toward covering the basic cost of living?

The answer varies a great deal on the personal circumstances of individuals. But it also depends significantly upon where seniors live, according to Jan Mutchler, a UMass Boston professor who leads the Gerontology Institute’s Center for Social & Demographic Research on Aging.

This is an important economic issue for seniors because Social Security provides such a large portion of total income for most beneficiaries. A third of those beneficiaries receive 90 percent of their income from Social Security. Three of every five depend on the benefit for at least half of their income.

Mutchler analyzed U.S. data on expenses and Social Security payments to determine the percentage of living costs covered by those benefits on a county by county basis. Along with co-authors Yang Li and Ping Xu, she recently published the findings in the Journal of Aging & Social Policy.

Nationwide, Mutchler found that Social Security benefits would cover 72 percent of living expenses, on average, for a single older adult in good health who lived in a rented home. Average social security benefits were not enough to fully cover the cost of living for seniors in a single U.S. county.

“As an economic safety net, Social Security provides critical support for seniors but it doesn’t fully cover basic living expenses and, in some regions, it doesn’t come close,” said Mutchler.

“Public policy discussion about the adequacy of Social Security often compares the benefit to federal poverty levels, which are based on assumptions made long ago and do not remotely reflect the reality facing seniors today,” she said. “That discussion also doesn’t take into account serious geographic differences that influence the economic security of older Americans. Our study provides a more realistic examination of the extent to which Social Security covers living expenses among older adults.”

Mutchler relied on 2016 expense data generated by the Elder Economic Security Index, a resource developed by her center. It measures realistic expenses, dominated by health care and housing, for adults aged 65 or older living independently. It also accounts for food, transportation and limited miscellaneous expenses for clothing and household necessities. The index reflects average market costs and does not take into account any needs-based subsidies.

She found the cost of living incurred by seniors varied significantly by state and even county. Average Social Security benefits also varied geographically, though to a lesser extent. As a result of variability in both of those measures, the extent to which Social Security can pay for the routine and basic cost of senior living – what Mutchler called the Elder Economic Security Ratio — depends significantly on location.

“The ratios impart novel information about the extent to which Social Security, the income resource most commonly held by older Americans, brings older adults closer to economic security in some communities than others,” Mutchler wrote.

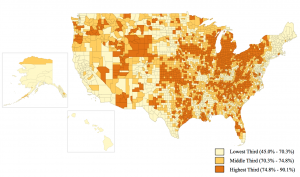

Percent of Elder Index for Single Renters in Good Health

Covered by Average Social Security Benefit in 2016 by County

For example, single senior renters living in California’s San Francisco County can manage to pay just 47 percent of basic expenses, on average, with Social Security benefits. Move to Pennsylvania’s Philadelphia County and that ratio grows to 60 percent. In Missouri’s St. Louis County, which counts more than a million residents bordering the city of St. Louis, the ratio grows to 85 percent

Take a closer look at San Francisco county: Expenses for the single senior in good health who rents were $32,568 per year. Average Social Security benefits were $15,369. That works out to an annual shortfall of $17,199.

On the other end of the spectrum, in St. Louis county, average social security benefits were only modestly higher at $17,691 per year. But annual expenses of $20,784 there made a big difference. The gap between Social Security and the cost of senior living in that county was only $3,093 a year.

But Mutchler noted that Social Security benefits are insufficient to support independent living for seniors virtually everywhere in the United States. She said the policy implications of her findings support not only improving Social Security and other late-life income sources, but also to helping older adults manage their expenses.

“Shifting the policy and practice conversation away from destitution and towards economic security is an important step toward improvement in this arena,” Mutchler wrote. “Beyond this important step, devising programs that help ensure older adults will have sources of income beyond Social Security, including opportunities to generate work income, are required.”

June 13, 2018 at 8:04 pm

This article identifies a critical gap in economic security of the older population. Added to this & unmentioned is the projected short fall in Social Security funding itself by 2034. To remedy that situation our political leaders need to step up. Yet public discussion has been nil.

June 30, 2018 at 4:19 pm

This is a study that is gravely needed also in the burgeoning immigrant communities that do not even have the safety net provided by social security.

July 26, 2018 at 3:12 pm

Given that the design of Social Security benefits only called for them to cover a portion of retirement income, do you think conservative policy makers may use this to argue that Social Security benefits are too high?