Category Economic Security

Last fall, a report by UMass Boston researchers showed that Medicaid reimbursements fall short of covering the actual costs of nursing home care for Medicaid residents. That research will now go a step further and try to examine how closely Medicaid payment-to-cost ratios affect outcomes in nursing homes.

In fiscal year 2023, staff members and volunteers at the Gerontology Institute’s Pension Action Center opened 330 cases and recovered $1.1 million in pension benefits, at no cost to clients. These facts and more are featured in the center’s latest… Continue Reading →

UMass Boston has begun a five-year partnership with the Center for Retirement Research at Boston College (CRR) as an affiliated research institution, a collaboration that opens opportunities for UMass Boston researchers and students. In the first year of the partnership,… Continue Reading →

The Gerontology Institute’s Pension Action Center (PAC) has been awarded two concurrent grants funded by the Investor Protection Trust, a nonprofit organization dedicated to independent investor education, research, and support. The two projects build on the expertise of PAC’s staff,… Continue Reading →

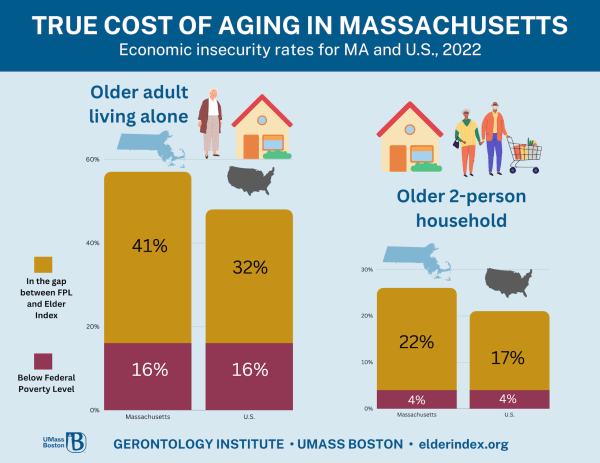

New Elder Index report finds high levels of economic insecurity among Massachusetts’ older residents

Massachusetts is home to the nation’s highest percentage of older adults living alone who are unable to afford basic necessities without extra assistance, according to new research from UMass Boston’s Gerontology Institute. Nearly three-fifths, or 57 percent, of adults age… Continue Reading →

A new analysis by the LeadingAge LTSS Center @UMass Boston and the National Council on Aging finds that 80 percent of older Americans—47 million—continue to be unable to sustain a financial shock such as needing to pay for long-term care… Continue Reading →

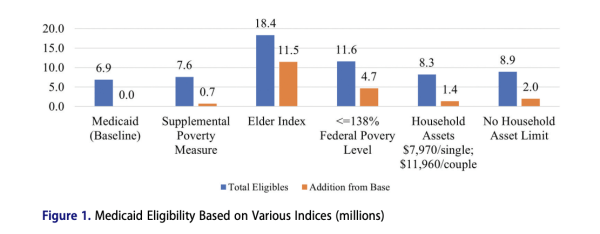

Researchers Marc Cohen and Jane Tavares know how crucial federal programs such as Medicaid health insurance and SNAP food assistance are for the most vulnerable older adults. “Our social safety nets are keeping so many people afloat,” says Tavares, a… Continue Reading →

New estimates from the Gerontology Institute at UMass Boston find that millions of older adults, especially those living alone, continue to live on incomes that fall below the Elder IndexTM, a county-by-county measure of the income needed by adults aged… Continue Reading →

By Marc Cohen, Caitlin Coyle, James Hermelbracht, Edward Alan Miller, Jan Mutchler, and Anna-Marie Tabor Older adults are the fastest-growing segment of the American population. In Massachusetts, adults 65 and older will make up nearly a quarter of the Commonwealth’s… Continue Reading →

Jane Tavares, PhD ‘18, always saw herself working with older people. Her Portuguese grandparents lived with her when she was growing up, so she watched them age and saw her family members pitch in with their care. Thinking she’d end… Continue Reading →