Tag

Jan Mutchler

Older women, especially those living alone, continue to experience an elevated risk of economic insecurity, as detailed in a new report, “Late-life Gender Disparities in Economic Security,” from the Gerontology Institute at the University of Massachusetts Boston. The report uses… Continue Reading →

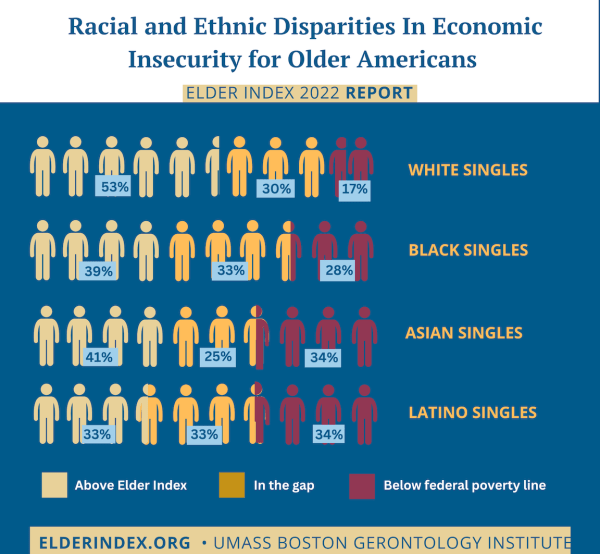

New estimates based on the 2022 Elder IndexTM show that the risk of economic insecurity in later life is especially high for people of color. National averages suggest that among older people living alone, 43 percent of people who are… Continue Reading →

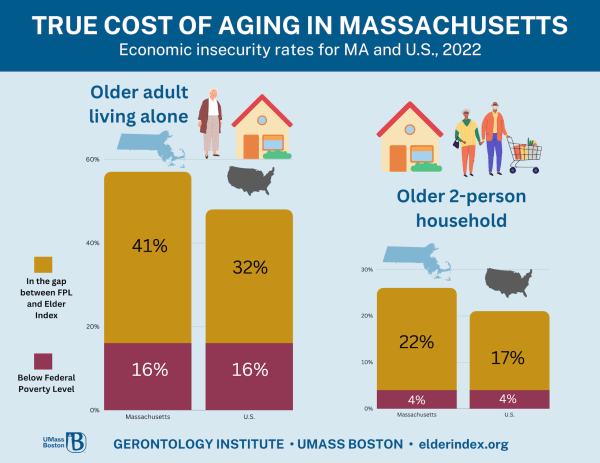

New Elder Index report finds high levels of economic insecurity among Massachusetts’ older residents

Massachusetts is home to the nation’s highest percentage of older adults living alone who are unable to afford basic necessities without extra assistance, according to new research from UMass Boston’s Gerontology Institute. Nearly three-fifths, or 57 percent, of adults age… Continue Reading →

By Marc Cohen, Caitlin Coyle, James Hermelbracht, Edward Alan Miller, Jan Mutchler, and Anna-Marie Tabor Older adults are the fastest-growing segment of the American population. In Massachusetts, adults 65 and older will make up nearly a quarter of the Commonwealth’s… Continue Reading →

“The center has built a reputation of being the people who local communities turn to when they have questions about their aging population.” Caitlin Coyle, PhD, directorCenter for Social and Demographic Research on Aging, UMass Boston In 1998, when Carol… Continue Reading →

Many of the doctoral students who have worked with Jan Mutchler over the years tell her they came to gerontology one of two ways—either they were close to a grandparent as they were growing up, or they worked with older… Continue Reading →

Reposted from a May 16, 2022 UMass Boston news post In August 2021, Jan Mutchler, PhD, was appointed director of the Gerontology Institute, succeeding former director Len Fishman, who retired after seven years of service. In considering how she may… Continue Reading →

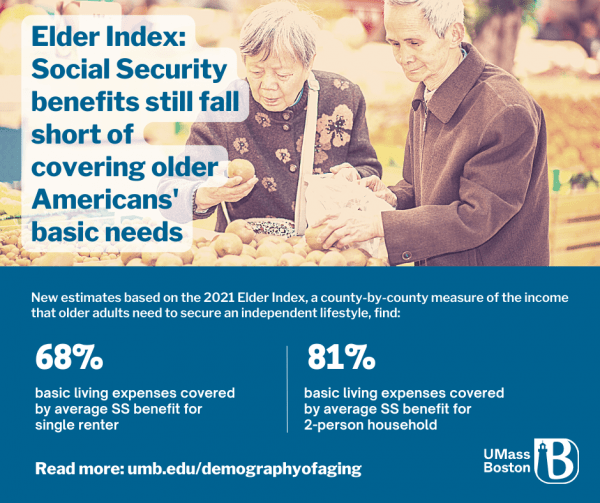

The National Council on Aging’s Equity in Aging Collaborative will work with the Gerontology Institute to train advocates on using the Elder Index for more accurate, regionally specific benchmarks of economic security. Nearly a quarter of all Americans age 65… Continue Reading →

For most of his 23 years at UMass Boston, Jeffrey Burr, PhD, has worked as an administrator in addition to teaching and conducting research on aging issues. From the State University of New York at Buffalo, Burr came to campus… Continue Reading →

Gerontology students at the University of Massachusetts Boston are returning to school, greeted by some familiar faces in new leadership roles. Professor Edward Alan Miller is the new chair of the UMass Boston Gerontology Department, succeeding professor Jeffrey Burr. Professor… Continue Reading →