Tag

Elder Index

Older women, especially those living alone, continue to experience an elevated risk of economic insecurity, as detailed in a new report, “Late-life Gender Disparities in Economic Security,” from the Gerontology Institute at the University of Massachusetts Boston. The report uses… Continue Reading →

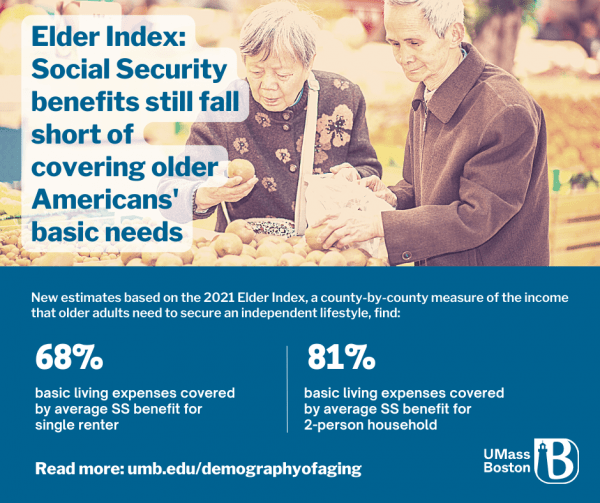

New estimates from the Gerontology Institute at UMass Boston find that millions of older adults, especially those living alone, continue to live on incomes that fall below the Elder IndexTM, a county-by-county measure of the income needed by adults aged… Continue Reading →

Doctoral student Molly Wylie named inaugural fellow for 2022-23. The National Council on Aging (NCOA) and the LeadingAge LTSS Center @UMass Boston have partnered to create an Equity in Aging Research Fellowship. The one-year graduate research position supports both organizations’… Continue Reading →

The National Council on Aging’s Equity in Aging Collaborative will work with the Gerontology Institute to train advocates on using the Elder Index for more accurate, regionally specific benchmarks of economic security. Nearly a quarter of all Americans age 65… Continue Reading →

Most older women spent their working lives behind the economic curve. They were typically paid less than men when at work and more likely to provide family care that reduced employment opportunities. Their economic situation doesn’t improve in later life…. Continue Reading →

I write to announce that Len Fishman, after serving seven years as director of the Gerontology Institute at the McCormack Graduate School of Policy and Global Studies, will be retiring on August 31. A nationally recognized leader in health care… Continue Reading →

This article is one in a series of stories about how people across the country are using the Elder Index to understand the true cost of living for older adults and its economic implications. If you know someone who would… Continue Reading →

Older adults in every one of America’s large metropolitan areas face serious challenges affording their local cost of living. But the scale of economic insecurity varies dramatically, depending on what city those older adults call home. A new report by… Continue Reading →

This article is one in a series of stories about how people across the country are using the Elder Index to understand the true cost of living for older adults and its economic implications. If you know someone who would… Continue Reading →

This article is one in a series of stories about how people across the country are using the Elder Index to understand the true cost of living for older adults and its economic implications. If you know someone who would… Continue Reading →