Category

Pension Action Center

More than 250 guests attended a “Summit to Fight Fraud” organized by the Gerontology Institute’s Pension Action Center at UMass Boston on March 19, 2024. The event, sponsored by Investor Protection Trust and co-presented by the Massachusetts Securities Division, featured… Continue Reading →

The Gerontology Institute’s Pension Action Center (PAC) has been awarded two concurrent grants funded by the Investor Protection Trust, a nonprofit organization dedicated to independent investor education, research, and support. The two projects build on the expertise of PAC’s staff,… Continue Reading →

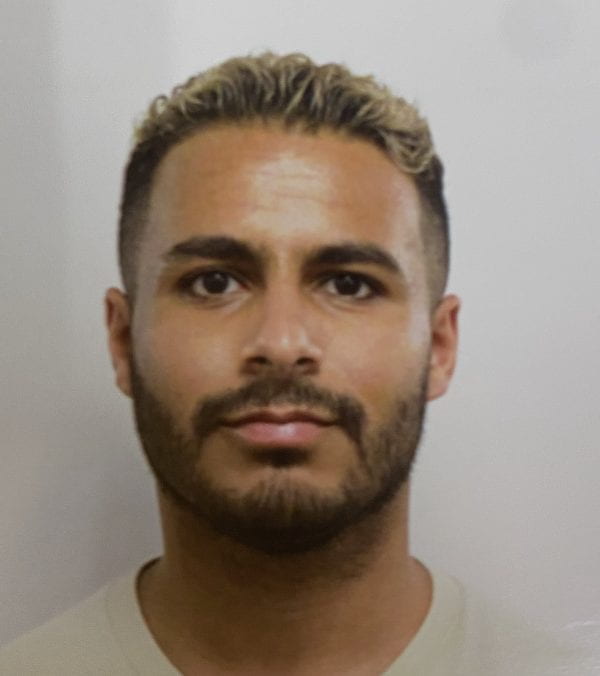

Raad Alsowayigh has joined the Pension Action Center (PAC) as its legal clerk, responsible for managing the client caseload and supervising the undergraduate interns who staff the center’s help line. Alsowayigh (his name is pronounced Rod Also-way-egh) graduated in May… Continue Reading →

Rin Hurd manages the help line at the Pension Action Center and codes survey answers for the Center for Social and Demographic Research on Aging Rin Hurd, a junior political science major at UMass Boston, admits to not knowing anything… Continue Reading →

Quantifying the racial wealth gap in retirement financial security, why it exists, and possible solutions were the topics of a panel presentation, “Race, Retirement and Financial Security,” presented on June 23 by the Pension Action Center and cosponsored by the… Continue Reading →

It took navigating a company merger, the sale of pension assets, and COVID work absences, but a volunteer counselor at UMass Boston’s Pension Action Center was able to track down and recover a client’s pension benefits. It has taken a… Continue Reading →

I write to announce that Len Fishman, after serving seven years as director of the Gerontology Institute at the McCormack Graduate School of Policy and Global Studies, will be retiring on August 31. A nationally recognized leader in health care… Continue Reading →

Lillie McWilliams passed away at the age of 86 without getting a dime of her pension. McWilliams worked at a hospital in Chicago as a housekeeper in the late 1970s and early 1980s. Her daughter, Carol Griffin, believes she never… Continue Reading →

There was a reason why Marco couldn’t find the pension he had earned many years ago. It didn’t exist any longer. Many clients call the Pension Action Center because they can’t figure out who is responsible for paying them benefits… Continue Reading →

Can you wear out a phone? The Pension Action Center at UMass Boston’s Gerontology Institute is always busy fielding calls from people seeking help to track down their pensions or investigate benefits they believe they are owed. But the pace… Continue Reading →