The National Council on Aging’s Equity in Aging Collaborative will work with the Gerontology Institute to train advocates on using the Elder Index for more accurate, regionally specific benchmarks of economic security.

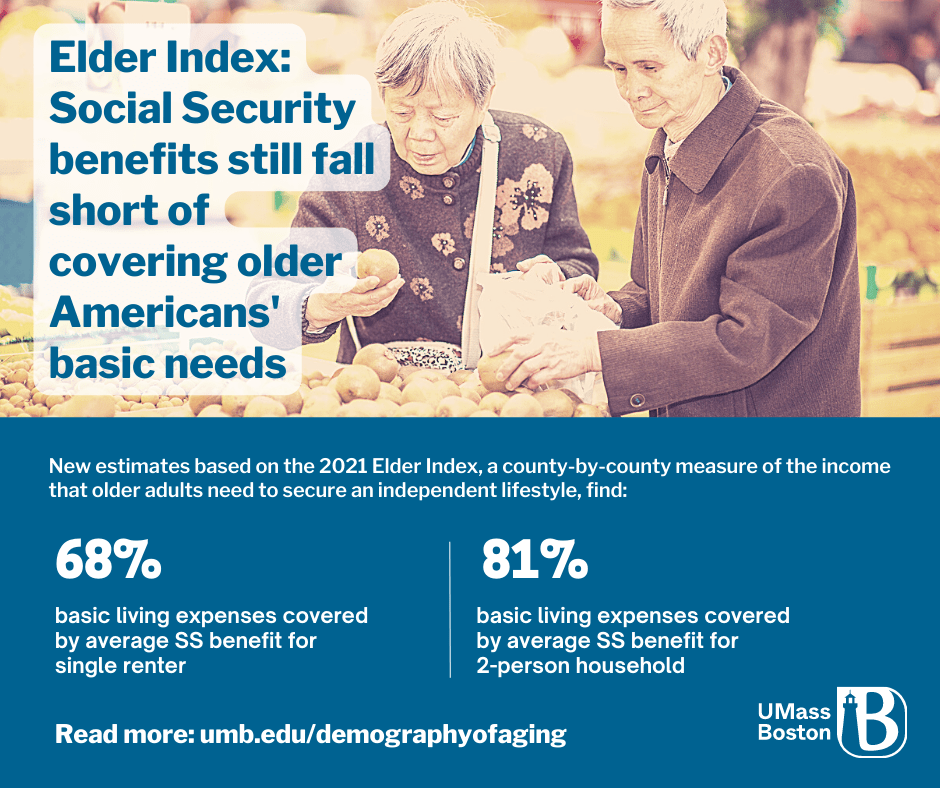

Nearly a quarter of all Americans age 65 and older depend on Social Security benefits for 90 percent or more of their family income. Yet nationally, the average Social Security benefit covers just 68 percent of basic living expenses for a single older adult—for housing, food, transportation and health care.

In a new report, “Social Security Benefits Continue to Fall Short of Covering Cost of Basic Needs for Older Americans, 2021,” Jan Mutchler, PhD, and doctoral student Nidya Velasco Roldán offer these estimates and more based on the Elder Index. Developed by UMass Boston gerontologists, the index provides a comprehensive reflection of the cost of living for older adults in every community across the United States.

Mutchler, professor of gerontology and director of the Gerontology Institute at UMass Boston, produces and disseminates the Elder Index. “The federal poverty line is widely used to summarize hardship and insecurity, but we know that the FPL benchmark is way below what an adequate lifestyle requires,” Mutchler says. “The Elder Index defines economic security as the income level at which older people can cover basic and necessary living expenses without relying on loans, gifts, or income support programs such as food subsidies and housing assistance. It is also uniquely focused on thresholds specific to older adults’ expenses, and looks at living costs county by county across the U.S.”

In an effort to engage and educate local and national stakeholders about older adults’ growing economic insecurity, the National Council on Aging (NCOA) is collaborating with the Gerontology Institute to train advocates on using the Elder Index through the establishment of the Equity in Aging Collaborative, led by Vivian Nava-Schellinger, NCOA director of Partnerships & Network Activation. This two-year effort, supported through a grant from RRF Foundation for Aging, creates a platform for shared learning among local, state, and national leaders across the country to advance a national conversation and elevate the need for systemic change around poverty among older adults. As an advocacy organization focused on healthy living and financial security, the NCOA is turning to the Elder Index for a more accurate reflection of basic living costs across the U.S.

“The COVID-19 pandemic exposed and exacerbated systemic disparities that leave too many Americans without the resources to age with dignity. The federal poverty level does not reflect older adults’ current needs and local differences in the cost of living ,” says Ramsey Alwin, NCOA President and CEO. “We would like to see the Elder Index used in determining eligibility for benefits programs and in allocating resources to states and communities for aging services.”

“Our work with NCOA is a great opportunity to move the needle towards strengthened financial security among older Americans,” says Mutchler. “Educating stakeholders about the financial challenges faced by older adults is a critical step in promoting security in retirement, especially in these times.”

1 Pingback